Auto Loan FAQ design

Improving loan completion through clearer guidance and reduced content overload.

UX Lead | 4 months | Cross‑functional team of 6

Context

Legal and compliance teams approved additional required disclosures for the Auto Loan Refinance page, but the information was difficult for members to find and understand. Dense text, unclear labeling, and accessibility issues increased confusion and support volume.

The business needed a clearer, more accessible way to present legally required information while improving loan completion.

Problem

Content Overload

Long blocks of compliance‑approved text made it difficult to find relevant information.

Unclear Information

Legal, technical, and loan requirements were mixed together without clear labeling.

Accessibility Challenges

NCUA standards required full‑length disclosures, but the layout made them hard to navigate.

The result: confusion, abandonment, and increased support burden.

Challenge

I had to present full legal disclosures without altering approved content, improve clarity and scannability, support accessibility requirements, and create a structure that could scale across future lending products.

CORE TENSION: maintain legal accuracy while making the experience usable.

Research & Discovery

Competitive analysis of major financial institutions highlighted common patterns for handling regulatory content, including accordion layouts and mobile‑first progressive disclosure.

User testing and support data showed members struggled to find required documents, next steps, and clear explanations within dense legal text.

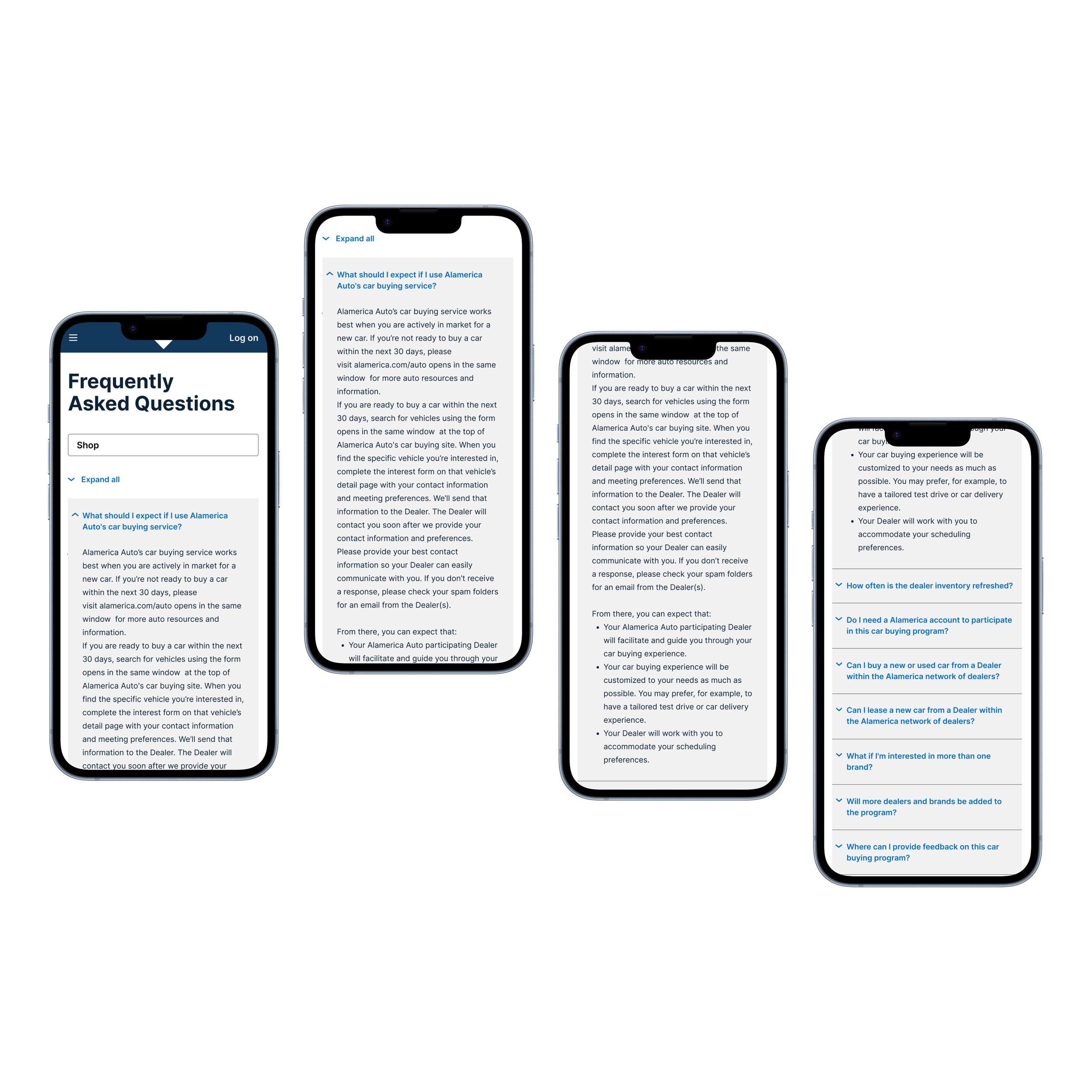

Audience insights revealed that older military veterans and 80%+ mobile users needed clearer hierarchy, readable text, and simplified navigation.

Accessibility review identified issues with contrast, scannability, and keyboard/touch interactions.

Stakeholder constraints confirmed that disclosures had to remain visible, reframing the challenge as how to present them, not whether to show them.

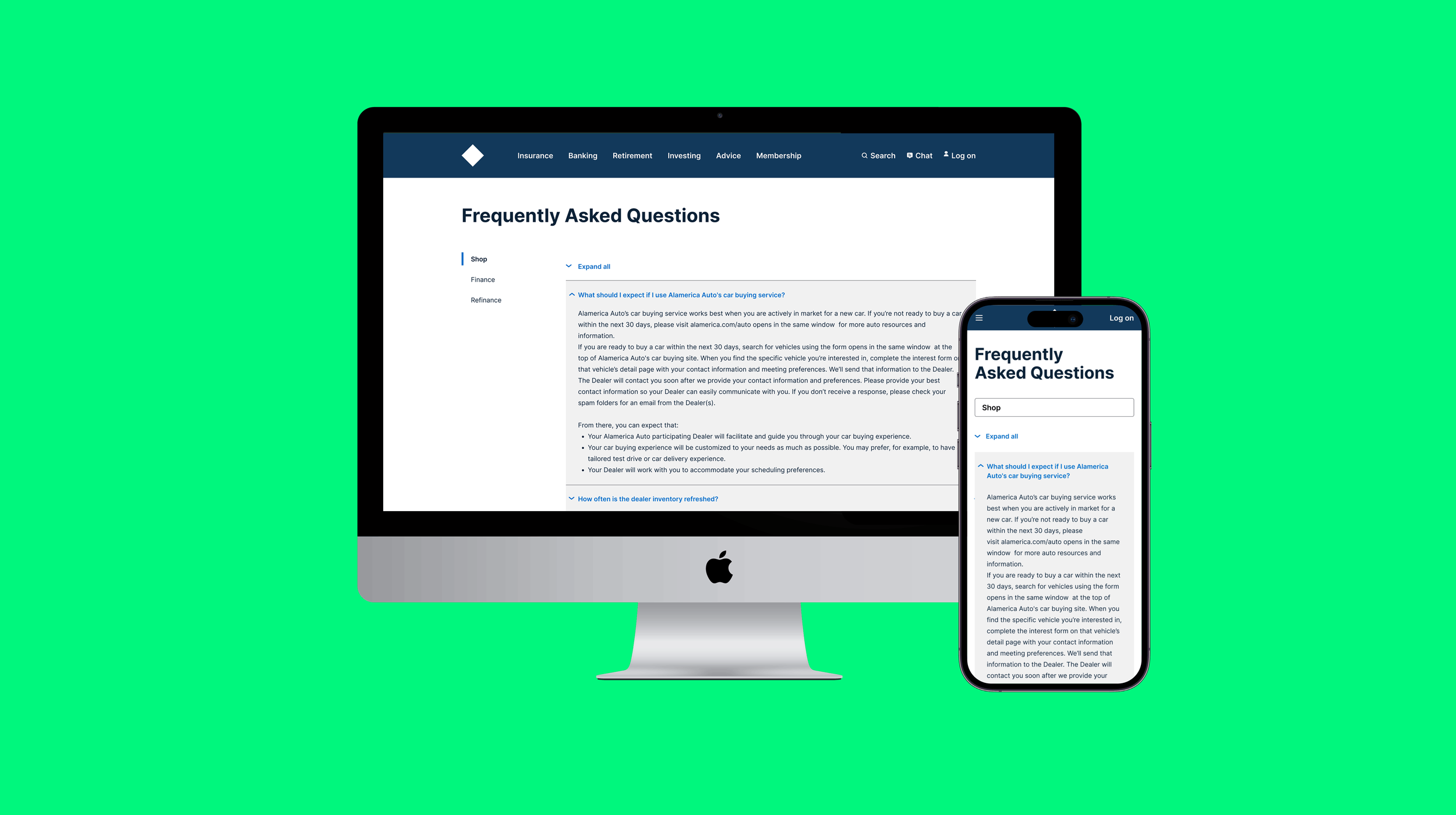

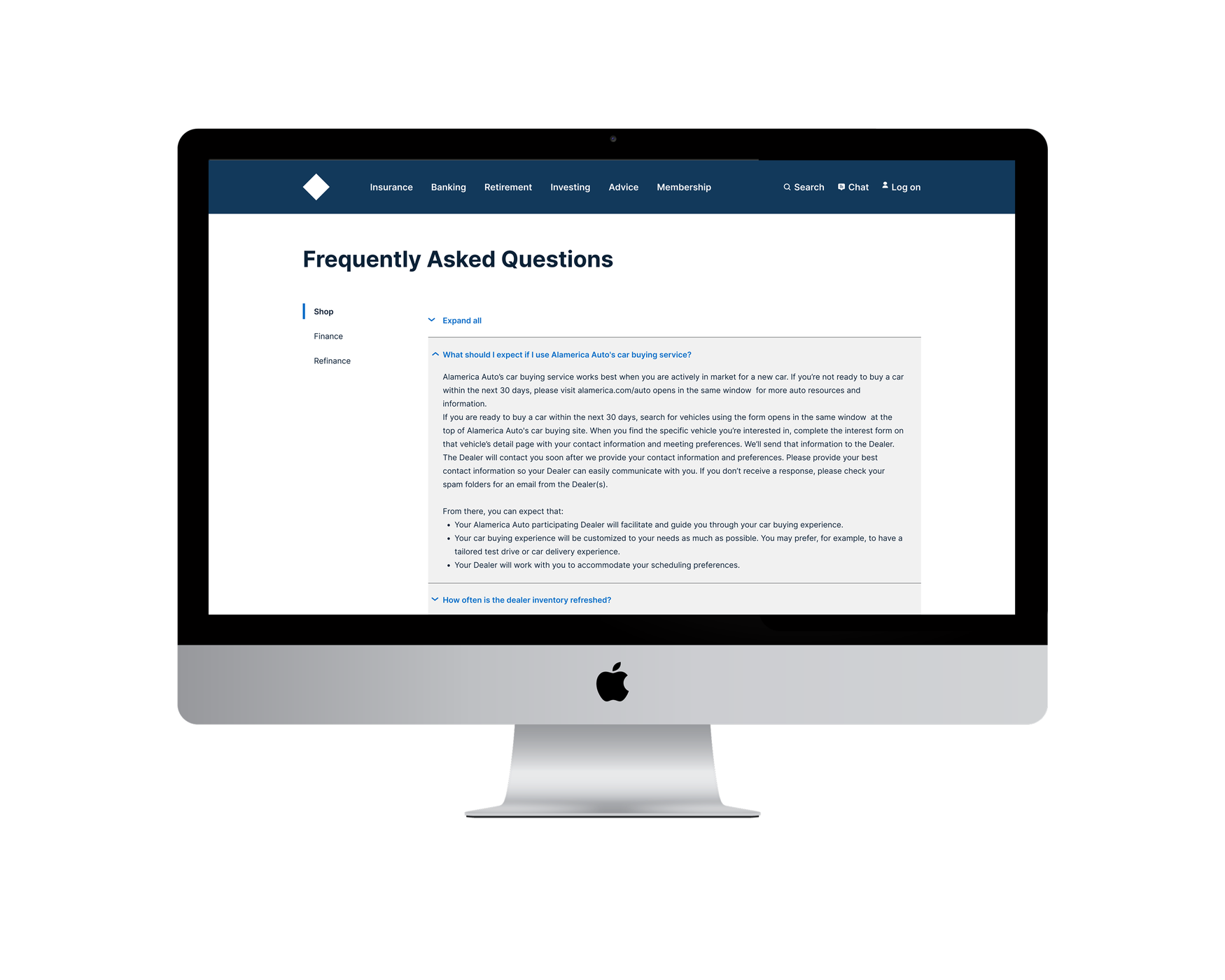

Desktop view of FAQ sectionSolution

A two‑part structure that met legal requirements while improving clarity and usability.

1. On‑Page FAQ Section

Accordion‑style FAQ embedded directly on the refinance page

Quick access to legal, compliance, and technical disclosures

Reduced scrolling and content overload

2. Comprehensive Auto Loan FAQ Page

Clear information architecture separating legal, technical, and loan content

Search and support functionality

Responsive, accessible layout with progressive disclosure

Clearer guidance for required documents

Mobile views of FAQ sectionResults

Improved readability and scannability

Increased accessibility for older users and mobile devices

Reduced confusion around required documents

Scalable FAQ template adopted across three other lending products

Met compliance and accessibility requirements without sacrificing usability