Help Me Decide

Helping customers make the right choices, helping the business too.

Team Specifics

Role: UX Designer

Duration: 4 months

Team: Marketing, Product Manager, Content Strategist, Developer

Tools: Sketch, InVision, User Research, Behavioral Economics Framework

Categories: UX Strategy | Behavioral Economics | User Research | Decision Architecture

Context

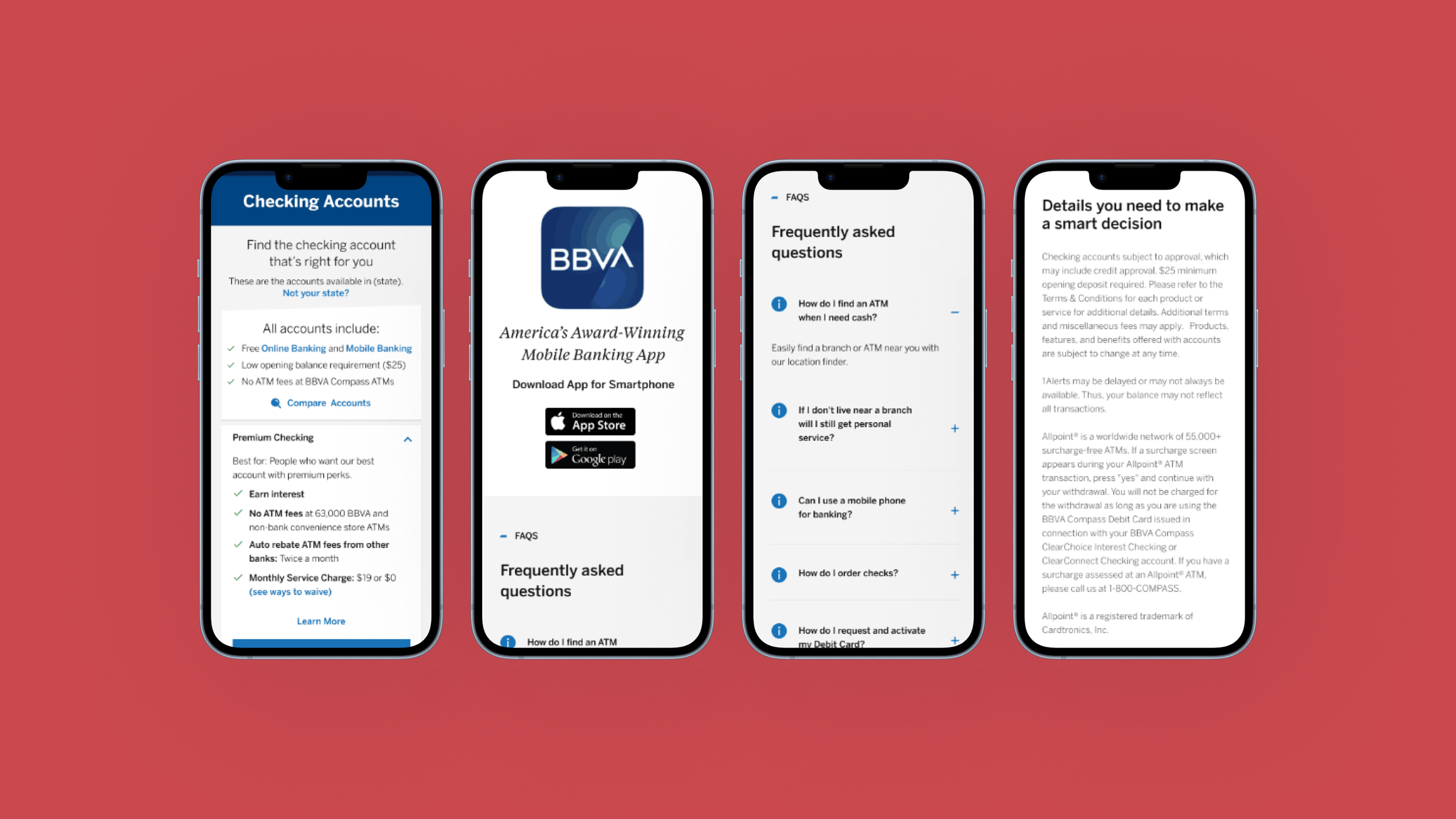

BBVA customers tended to default to our free checking account option because the label "free" seemed most appealing. However, their lifestyle may have been better suited by a different bank account. Due to the similarities of the bank accounts we offer, this tool was created to help customers select the bank account that is most congruent with their lifestyle.

Business Challenge:

Marketing needed a way to guide customers to optimal accounts without appearing pushy while addressing a critical revenue problem: customers selecting free checking were costing BBVA millions in lost deposits from higher-value account options.

Original design: Cognitive overload lead to customers choosing the free checking account.

Problem

Very Similar Accounts

While organizing our accounts, we noticed that many of them looked similar. These similarities made it difficult for customers to make a decision on which account would provide the best fit for their needs.

The "Free" Problem

Our marketing team asked us to help our customers choose the account that would best fit their needs. Initially the solution seemed simple; we would show the customer accounts that we have and they would intuitively choose the right one. However, we discovered that most users ignored all other accounts once they saw "free" and immediately signed up for the free checking option, which led to BBVA losing millions of dollars in deposits.

Technical Constraints

Most customers selected free checking immediately upon seeing "free" label

Many customers were better suited for interest-bearing or cashback accounts.

Standard comparison tables overwhelmed customers with too much information at once.

Challenge

The word "free" was psychologically magnetic—customers defaulted to free checking immediately, costing BBVA millions in lost deposits from higher-value accounts. BBVA's checking accounts looked nearly identical; differences that mattered were buried in fine print. Comparison tables overwhelmed customers.

Had to guide them to better-fit accounts without dark patterns or manipulation. Marketing wanted to "nudge" customers toward higher-value accounts, but the solution had to feel like a helpful service, not a sales tactic. Any guidance had to be transparent and tied to customers' stated needs.

Research & discovery

Behavioral Economics Foundation

Researched loss aversion, choice architecture, and decision fatigue principles to understand how to guide customers without forcing decisions.

Competitive Analysis

Reviewed 6 major banks' account selection flows. Most relied on comparison tables or lengthy forms. Few used guided, progressive experiences that reduced cognitive load.

User Research Insights

Through user testing and analytics, we found customers:

Felt overwhelmed by comparing multiple similar accounts at once

Didn't understand the practical differences between account types

Defaulted to "free" as a safe choice when uncertain

Wanted guidance but didn't trust pushy sales tactics

Design Principles:

Progressive disclosure to reduce overwhelm

Guided experience based on user needs, not bank priorities

Clear value communication without hiding the free option

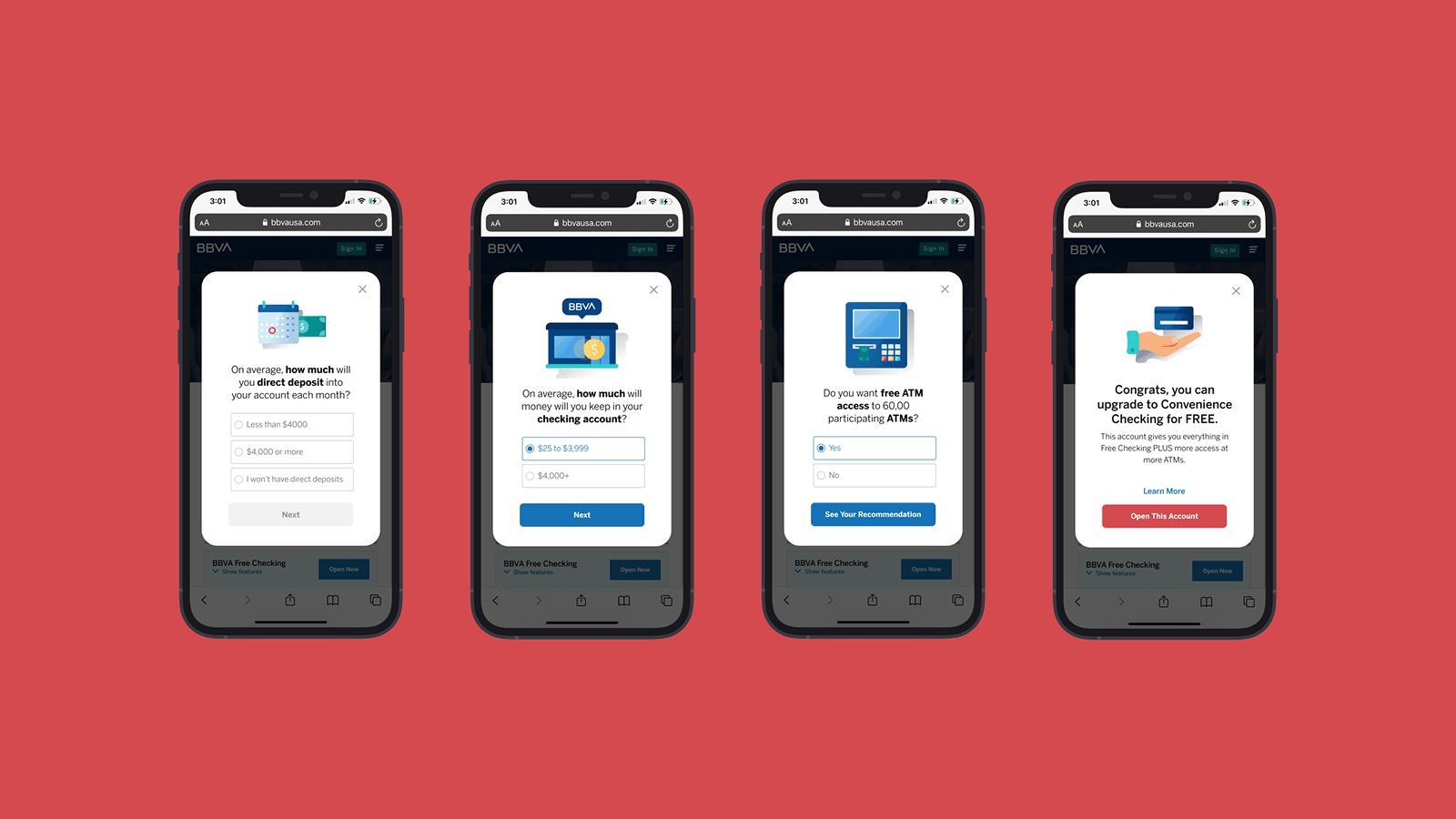

Mobile-first responsive design for all device types

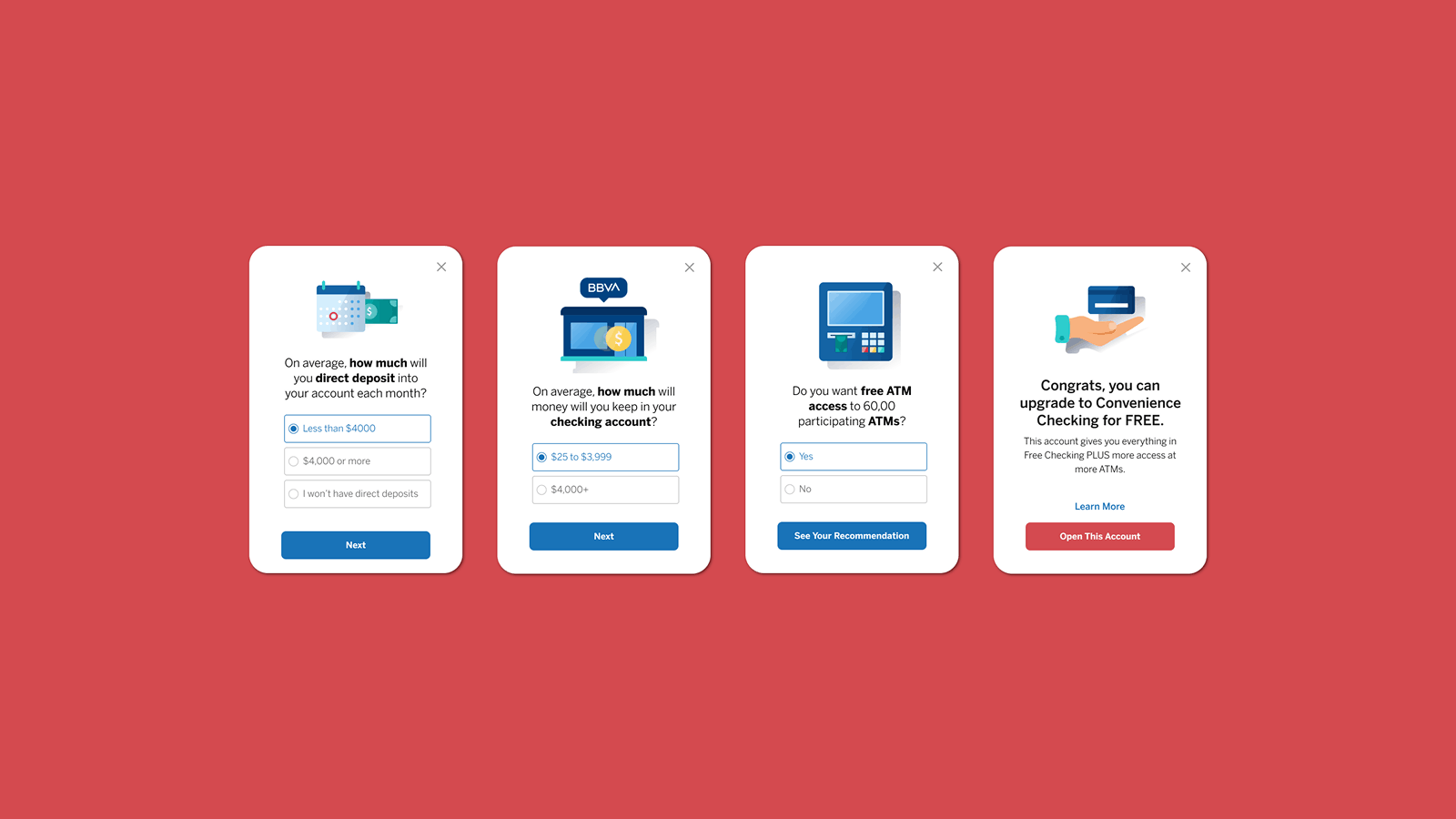

Decision Matrix: 3 accounts 6 different paths.

Solution

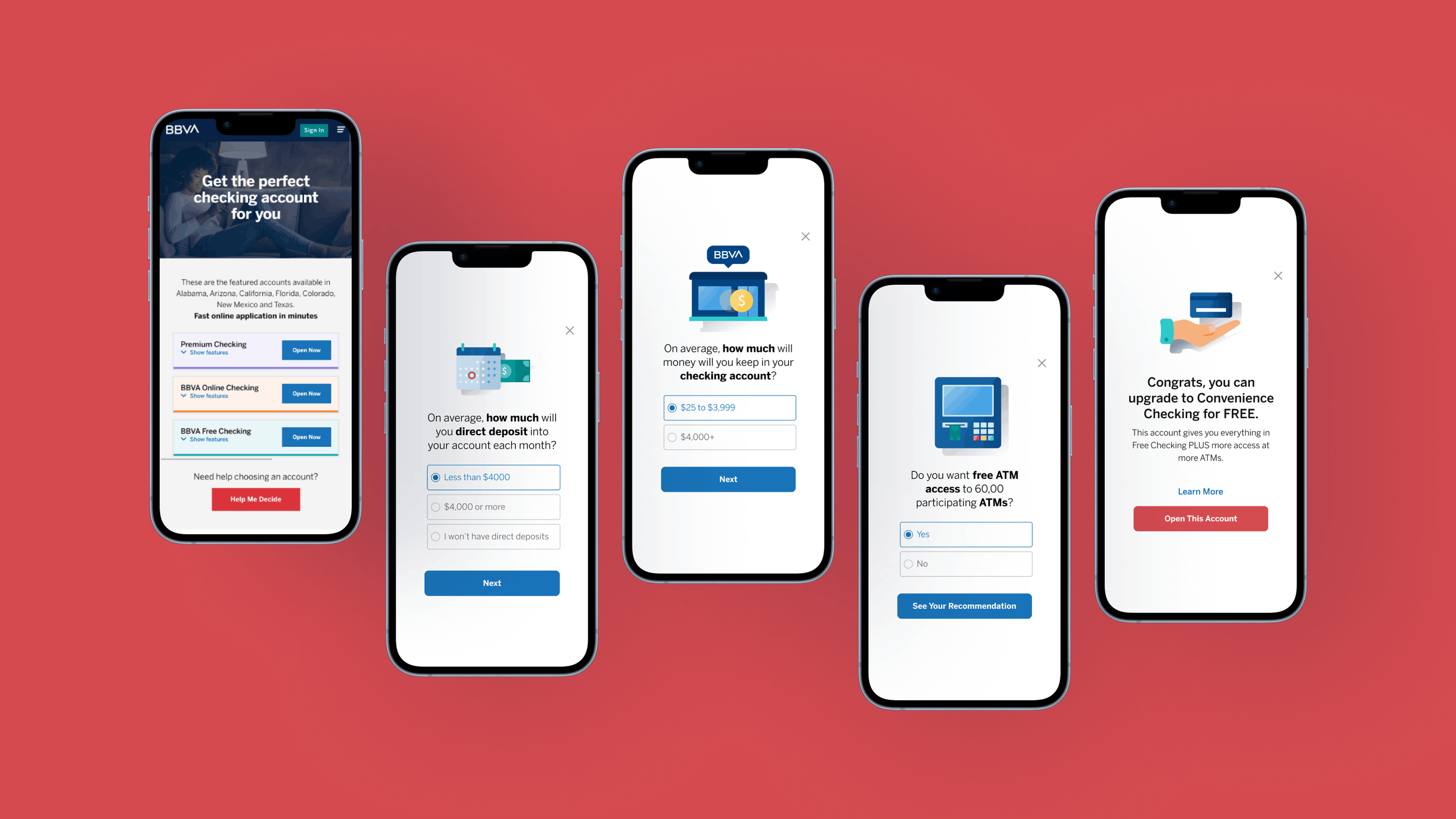

Our team created the Help Me Decide modal considering these challenges in order to streamline the customers' decision-making process. This tool allowed the customer to go through three simple prompts to narrow down their choices to the 3 bank accounts that would best fit their lifestyle.

Design Approach:

Created a 3-step progressive questionnaire that felt conversational, not interrogative

Used clear, jargon-free language to explain account differences

Showed personalized recommendations based on customer inputs

Maintained transparency by allowing users to see all options afterward

Designed mobile-optimized interface for seamless experience across devices

The modal guided customers through questions about:

Their average monthly deposit

Their typical account usage patterns

Their preferences for account features and benefits

Based on their responses, the tool recommended the top account matched to their needs, with clear explanation of why the account was suggested.

Help me Decide modals

Results

Business Impact:

The Help Me Decide Tool has been recognized by some of the best in Behavioral Economics and has contributed to a lift of more than $2.7 million in annual incremental value to BBVA USA.

Conversion & Engagement:

Increased selection of higher-value accounts

Reduced decision-making time significantly

Improved mobile completion rates across all device types

User Experience Improvements:

Customers felt more confident in their account choice

Reduced cognitive load through progressive disclosure

Maintained trust by keeping free checking visible as an option

Created reusable pattern for other product selection flows

Recognition:

Featured in behavioral economics case studies and industry publications for effective application of choice architecture and decision science.

See it live here.

Help me Decide screens

What I Learned

Behavioral economics is a design tool, not manipulation—when used ethically. Our tool worked because customers were genuinely better served by accounts matched to their behavior. We just helped them see it.

Progressive disclosure reduces decision paralysis. Breaking the decision into three simple questions reduced cognitive load dramatically. People want guidance, not complex tradeoffs.

Context matters more than features. Customers don't care about "0.01% APY"—they care about "will this save me money given how I use my bank?" Reframing features as outcomes made value immediately clear.

Best persuasion doesn't feel like persuasion. The tool succeeded because we showed our reasoning, maintained transparency about all options, and let customers override recommendations.

Recognition validates impact beyond internal metrics. Being featured in behavioral economics case studies confirmed we'd applied principles effectively and ethically, advancing the practice itself.